CFD on securities

Make money on the movement of shares of large international corporations, using AdeGroup's capabilities in the form of ultra-fast execution and tight spreads. The range of shares will include securities of well-known companies from the EU, USA, and UK.

What you need to know about stocks and the stock exchange?

Shares are securities that a public company that has gone through an IPO has the right to issue. The issue of shares serves one main purpose - to attract additional financing. Each person who buys a share receives an ownership interest in the company. Therefore, he is entitled to a portion of her income, paid in the form of dividends. In addition, shares are traded on the stock exchange, where their value fluctuates due to changes in supply and demand.

If a company successfully conducts business, expands, develops, and its profits grow, then both the shares themselves and derivative assets - CFDs and futures contracts - become more expensive. The principle of making money for a trader on the stock market is quite simple - he needs to buy a share in order to sell it at a higher price. Or sell it and then buy it back cheaper and get the difference as a profit.

How does the stock exchange function?

A company intending to issue shares must go through the Initial Public Offering procedure, or IPO for short. It's not easy to get through. Because the company must meet a number of stringent requirements. Plus some serious financial institution must vouch for it. Most often, this role is played by a bank that conducts business performance research. Having passed all the obstacles and proven its worth, the company, at the end of the IPO, issues a certain number of shares, which are listed on one or another stock exchange. After this, anyone can trade shares, as a chart and buy/sell tools appear.

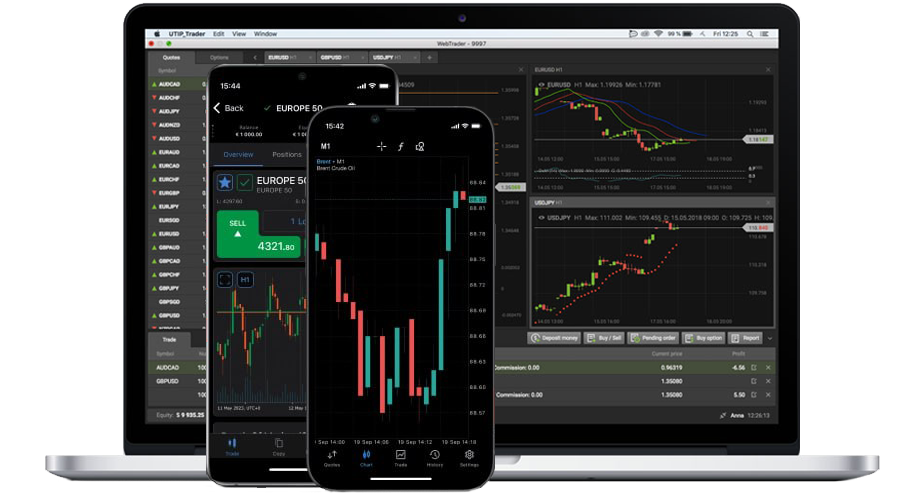

To make public trading as fast and comfortable as possible, trading platforms and brokerage organizations provide terminals through which the retail trader receives quotes and mechanisms that allow him to analyze the current market situation and enter into transactions of an investment or speculative nature.

How to start opening trades?

At the dawn of the stock market, trading participants could only earn money by purchasing shares. That is, they tried to buy cheaper in order to sell more expensive. Stock prices were published in newspapers; there were no electronic means of communication at that time. To buy, you had to call the broker, who would execute clients' orders. At the same time, the purchase of a security was no different from the purchase of any other goods. The buyer actually became their owner. This took a lot of time, involved a lot of red tape, etc. To correct this inconvenience, derivatives were invented: futures, CFDs, options, etc.

CFD (Contracts for Difference) is the most advanced of financial derivatives. This mechanism appeared in the 90s of the 20th century. Its main advantage is that it allowed small retail traders to transact in any traditional asset without any restrictions. This allows you to enter into trading with small amounts, and not as before, when the minimum deposit was tens of thousands of dollars. In addition, derivatives made it possible to make money not only on the growth of an asset, but also on its fall.

All shares traded on exchanges have a par value. Its calculation is based on the following logic: the total value of the company's authorized capital is divided by the number of shares in circulation. But real market prices often differ from the obtained value. Because bidders also evaluate other factors. For example, the company's development prospects. Then, due to increased demand, shares soar above their nominal values. Likewise, they can fall below par value, making the stock undervalued and potentially a good buy. The trader’s task: to determine the current trend in order to make money on the rise or fall in the actual value of securities.

To start opening transactions with securities, you will first need to choose a reliable broker. The period of operation, reviews, trading conditions and licenses will help determine it. In addition, you should evaluate its convenience personally for yourself by studying the list of tools, additional services, etc.

To start opening transactions with securities, you will first need to choose a reliable broker. The period of operation, reviews, trading conditions and licenses will help determine it. In addition, you should evaluate its convenience personally for yourself by studying the list of tools, additional services, etc.

AdeGroup provides its clients with regular analytical forecasts, including signals from the Trading Central service based on technical and graphical analysis. Plus, the site has a Calendar of Economic Events and a Calendar of Dividend Payments. Using these tools, it will be easier to find profitable situations for making money.

For those who are just taking their first steps in the field of investment and trading on global financial markets, AdeGroup offers free training. The broker's experts have prepared a theoretical and practical course, the completion of which will first of all introduce you to all common mistakes. Knowing them will already help you act much more successfully at the start, avoiding situations that most often lead to loss of money. Having taken the right start and relying on the professional analytics provided by AdeGroup, you will be able to take your first steps as confidently and calmly as possible, counting on receiving a stable influx of profit.

AdeGroup monitors current trends and the emergence of advanced technologies, responding in a timely manner and implementing all tools worth attention. Therefore, the broker's clients have access to the best software and can trade the most popular stocks in the most suitable conditions. Moreover, although CFD does not involve physical ownership of shares, the broker pays dividends accrued by the real issuing company, which allows you to use AdeGroup for profitable investments.

Current market prices for any asset - from currencies and cryptocurrencies to stocks and various commodities - can be easily viewed by opening the web page of the financial instrument of interest. There will also be other important information on conditions and various parameters, which allows you to identify the current trend, open a deal from an AdeGroup account and earn money

Advantages of cooperation with AdeGroup

All client transactions are transferred to liquidity providers.The broker does not interfere with the execution process, which ensures lightning-fast processing speed from 5 ms. Over the past year, the transaction execution statistics per second amounted to +3000 trading operations.

Average order processing time 15 ms

+6000 trades processed within a second

Zero ping from AdeGroup data center to trading servers

Choose the terminal that suits you

We provide our clients with a large selection of convenient mobile, PC and web platforms: MyTrading, Web-Trader, PC-Trader.

Choose the account that suits you by studying the features of individual accounts in table for comparison

Learn more about stock trading at AdeGroup

Company shares – what are they?

Shares are securities issued by commercial public companies that allow them to raise additional funds to establish and scale their business. Investors buy shares on the stock exchange through a brokerage organization to make a profit, expecting their further growth. If the forecast turns out to be correct, the investor will make money. If not, he will lose.

Initially, trading in securities presupposed the actual physical possession of the purchased share. However, subsequently, in order to make the stock market more accessible to the general public, CFD contracts were invented.

Contracts for Difference (CFD) began to be actively used at the end of the 20th century. Their appearance allowed small private traders who do not have large capital to buy and sell fractional shares of a lot of shares, oil, gold, currencies and other assets with leverage. The advent of CFDs made trading accessible to everyone, forever changing the rules of the game.

When assessing the prospects for buying and selling shares, it is important to take into account their nominal value. By comparing it to current market values, it becomes easier to understand how overvalued or undervalued a security is. Having this information, it becomes easier to analyze trends and make money.

Using CFD contracts, traders, unlike classical investors, can make a profit both when the value of assets increases and when they decrease. In combination with the provision of leverage, this provides the opportunity for significant earnings in any phase of the market.

To open trades you need to have an account with a brokerage company. It is important to pay attention to the conditions under which it offers to cooperate and what analysis tools it provides. For example, AdeGroup provides free use of signals from the well-known Trading Central service and control the market situation by monitoring the news feed of the reputable agency Sqwark.

The AdeGroup website also offers clients a Dividend Payment Calendar and a Macroeconomic Events Publication Calendar. By tracking them, you can prepare in advance for important events that will affect the movement of quotes.

When trading shares, it is very important to monitor the news background for those corporations that he has selected for opening transactions. And to make money, it is better to choose the most liquid securities of such well-known corporations as Facebook and Google, Apple and IBM, JPMorgan and Barclays, Coca Cola, etc. It is important to monitor not only corporate news, but also the general background in the country where the company operates . Because the overall economic situation directly affects the state of the stock market and the price of individual shares.

Another significant criterion is the general situation in the sector. Each company is represented in a specific industry, the situation in which depends on the political and economic background. Therefore, it is worth tracking stock indices that reflect the current state of affairs. For example, focusing on the DJ30 index, you can understand what is happening in the manufacturing sector.

Beginners in trading are strongly recommended to use the services of the educational center, carefully study analytical reports and only then start trading. And don’t forget about risk management, because risk control is the key to success. If you have any questions, your personal manager and support service are always at your service.

AdeGroup provides the opportunity to make money on the most popular stocks, the market prices of which you can find right here. All shares reflect the real value of the company that issued them. And traders can expect to receive dividend payments if they hold the securities of the relevant issuer.

The prices of any asset can be seen by going to its page. In addition to quotes, there are comprehensive terms on trading conditions and current trends. And from there you can immediately go to the terminal to open a transaction.

More assets - more opportunities!

Form a stable and promising investment portfolio using the dependencies of different assets!